Insurance Solutions

Broad coverage, unmatched risk management & operational guidance at a competitive cost

Coverage

Future Care Risk Retention Group offers Professional Liability, General Liability, Employee Benefit Liability and other supplemental coverages for senior care providers throughout the United States.

Future Care RRG is dedicated to empowering long-term care providers through innovative insurance solutions, collaborative risk management, and proactive claims strategies. Our mission is to foster a community of like-minded owners and operators who are committed to delivering exceptional care while navigating the complex challenges of the industry. By prioritizing membership, collaboration, and representation, we provide custom-developed coverage and support that drive excellence and sustainability in long-term care.

Through our risk management partners, Future Care provides so much more than just insurance coverage. We provide a robust risk management program tailored to the specific needs of each of our members. We’re proud to offer affiliated tailored specialty programs that structures policies and procedures to provide a fortified defense to mitigate the severity of potential claims.

Coverage Highlights

Claims Made Coverage

Incident Sensitive Coverage Form

Broad Coverage Trigger

Professional Liability (PL)

General Liability (GL)

Employee Benefits Liability (EBL)

Extended Reporting Period (ERP)

Stand-Alone ERPs

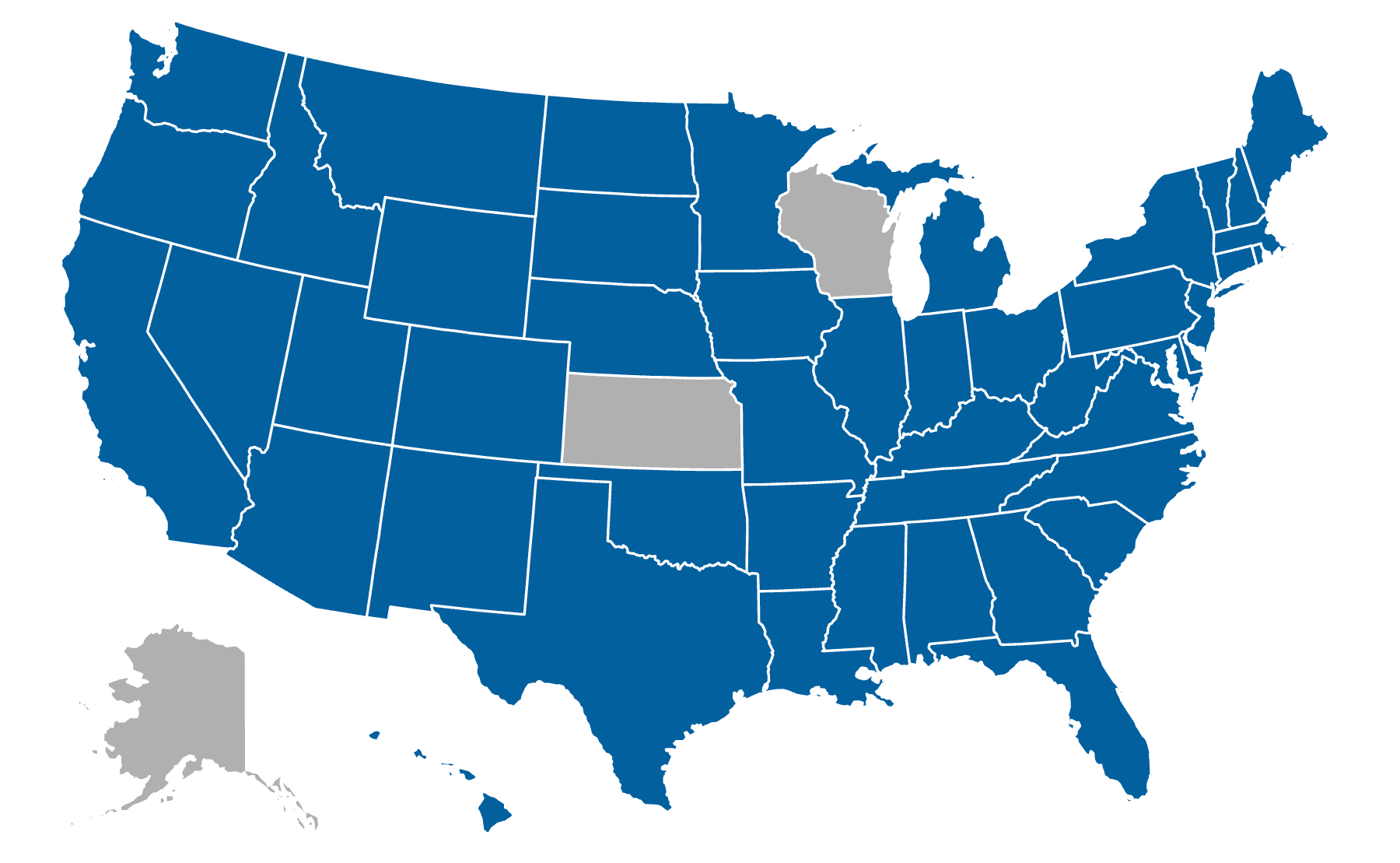

Currently available in 45+ states

Profile Appetite

Skilled Nursing Facilities Assisted Living Facilities

Independent Living Facilities Intermediate Care

Sub-Acute Care includes Tube Feeding, Ventilators, Tracheotomy and Complex Wound Care

Post-Acute Short Term

Continuing Care Retirement Communities Both For-Profit & Not-for-Profit Entities

Single location in a rural area to senior care facilities with multiple locations

Nursing home corporations with large chains that own facilities across the country

At Future Care, we are proud to provide underwriting in more than 45 states across the country.

Expense Reimbursement Options

Resident Property Loss, Medical Payments, Legal/Media Expense, Evacuation Expense and Fire Legal Liability

Limits of Liability

From $100K/$300K to $1M/$3M

Separate Tower for PL & GL available

Limits Per Location available

Total Maximum Policy Aggregate $10M

Defense Expenses

Inside the Limits (standard)

Outside the Limits via endorsement

Deductible & Self-Insured Retentions (SIR)

Up to $500,000 per claim deductible options

Self-Insured Retention (SIR)

Additional Customized Layer Options

Affiliate Tailored Specialty Programs

Fronting Program

Rent-A-Captive

Captive Solutions - including Captive Management

Coverage Enhancement Options

Sexual Abuse & Misconduct

Personal and Advertising Injury

Medical Director for Administrator Services

Volunteer for Administrative Services

TRIA available

Administrative/Disciplinary Proceedings Cost

Property of Patient

Departed Entities Endorsement

Captive Management

Risk Services is flexible enough to meet the service needs of all their captive clients. Having formed a large number of captives over many years, in multiple domiciles, the principals of Risk Services have the insight and knowledge to proactively address the issues that regulators may raise. Their familiarity with individual state requirements and nuances is unmatched and they pride themselves on the ability to meet all of a captive’s ongoing needs.

Application and Licensure

Multi-State Registration and Premium Tax Filings

Financial Management and Reporting

Regulatory Compliance Services

Troy Winch, Risk Services Vice President and Director of Captive Insurance, is a Certified Public Accountant who has over twenty five years of experience in the formation and management of captive insurance companies. He has worked with a diversified group of single parent captives, group/Association captives, Risk Retention Groups and segregated cell facilities. Troy’s client base includes a variety of industries such as transportation, auto warranty, health care entities, health care professional groups, long-term care facilities, higher education, retail, life insurance, travel, advertising, and non-profit organizations.

Michael Rogers, Chairman and CEO, is a Chartered Accountant and a Chartered Property Casualty Underwriter specializing in the formation and management of alternative market entities. He is an expert in the structuring of alternative market programs and is the key relationship manager responsible for the account during its formation, licensing and start-up phases. Michael also heads up the reinsurance intermediary division that has been very successful in seeking out reinsurers and fronting carriers who are familiar with the needs of captives and RRGs.

About Risk Services

With roots stemming back to the first true domestic captive domicile legislation in Vermont, Risk Services is one the oldest captive managers in the United States. They’ve managed well over one hundred captive insurance facilities and formed more Risk Retention Groups over the past decade than any other captive manager.